Posted on February 22nd, 2021

Undoubtedly FinTech is the new disruptive force that will take on the finance and banking sector. Despite having regulatory overhauls, recessions and multi-million fines, fintech is doing great and is presently the core of any bank’s business.

Fintech isn’t just limited to payments any longer and encompasses investment banking, direct lending and what not. Forget not we are also coming across terms like cryptocurrency and blockchain technology which will be the future of how financial transactions and banks will function.

By now you may have understood that the fintech sector is here to stay for long. In case you are a finance-savvy techie or a tech-savvy banker then fintech will be a great career opportunity for you.

Before looking into career opportunities and its future, let us see what FINTECH is all about in detail.

FinTech is nothing but applying digital technologies to provide financial services and products.

To say it in more simple terms, if eCommerce is the tech-retail hybrid for retailing, FinTech is the technology hybrid for banking. Fintech uses technology to give the best experience and usage value for the existing service or product.

Over the past 20 years, implementation of technologies such as cloud computing, internet and mobile application has drastically changed the financial industry.

FANGs or BigTech drive the fintech sector. FANGs or Big Tech mean big technology firms such as Facebook, Amazon, Netflix and Google. These firms have a big pool of global customer data using which they sell their services and products. These services majorly include digital wallets, payment handling and online selling of financial services and products. This Big Tech and its services are the 1st drivers of FinTech.

The 2nd driver comes in the form of a cluster of 100s of small FinTech organizations that have found solutions to answer real challenges such as user-friendly interfaces and cybersecurity.

The last and the 3rd driver is the banks themselves. The modern-day banks don’t wish to stay behind and are following the footsteps of tech firms.

When properly analyzed, FinTech firms give more job opportunities than BigTech or technology firms. While the tech firms focus majorly on technology advancement, fintech firms focus on technology besides financial services. The fintech industry is also larger in terms of the human resource requirement and the industries it serves.

Here are a few jobs you can try in the fintech industry:

Artificial Intelligence & Machine Learning:People having right skills are already in demand because both banks and BigTechs need them to build tools to answer the future.

WealthTech and Robo-advisors:Excellent is a small word for opportunities as this industry is rapidly growing. The growth rate is about 25%-30% every year. Furthermore, untapped potential is plenty.

RegTech:Regulatory rules and guidelines have turned complex than in the past. Besides, the need for developing new technologies to counter frauds in the banking sector is also on the rise. So the demand for this skill is far beyond than you can expect.

Cybersecurity:With the growth of online transactions, the need for enhanced and secured online transaction systems is a day-to-day need. And in this wake, the opportunities for cybersecurity specialists will stay as long as there is the banking sector.

Blockchain and Cryptocurrencies:Blockchain has cemented its position, very soon cryptocurrency too will cement its position. At present, the demand is good but, soon it will be the best.

Mobile App Development:This segment is now no more the fort of technology companies alone. If you can master this subject banking sector has doors open for you.

Payments/ Billing/ Money Transfers:Can you imagine the banking sector without people for these functions? No, right? So, jobs are always there if you are good at these skills.

Peer-to-peer lending:This is another role that is most demanded. Banks find it costly to look after and analyze small loans and, so they outsource and contract these roles.

Crowdfunding:Untapped potential is high and also the opportunities. This is one part of the fintech industry that is breaking the ground of traditional loan and credit services.

The above list is good but getting a break into these above jobs is not easy unless you can develop at least one skill and showcase to the employers that you are a good fit for this sector. Also, keep in mind that the banking sector is now no more limited to just government sector.

If you get specialized in the skillsets needed for fintech industry you can work for:

Finally, you can also switch the sectors.

FinTech is here to stay but, the actual question is in what way, form or shape will it stay and evolve. Will the technology giants take over the bank’s conventional territories? Will banks grab back control and look for apt partners to aid them in creating the best technologies? Will FinTech firms be capable of shaping out specific markets of their own and withstand pressure from the big names?

At present, it looks like there will be a little of everything. While banks have a few types of products and services that give them advantage and revenues, fintech firms also have tools and products that generate good revenue. Coming to the big tech firms’ factor, they stand in midway between these two.

However, leaving aside all these, and, talking from a career point of view, fintech, has opportunities for this year and also the coming 5 to 6 years. A skilled person is wanted by banks, startups and tech firms alike always.

#fintechjobs #in-demandfintechjobs #highpayingfintechjobs #2021fintechjobs #financeandbankingsector

Self-help To Improve Your productivity In Office

Self-help To Improve Your productivity In Office Tips To Tackle Your Appraisal Meeting

Tips To Tackle Your Appraisal Meeting 10 Signs That Say Your Job Offer Is On Its Way

10 Signs That Say Your Job Offer Is On Its Way These 10 jobs are most demanded in Canada

These 10 jobs are most demanded in Canada How can recruiters take the aid of digital transformation?

How can recruiters take the aid of digital transformation? Is Being A Data Scientist In Your Mind….?

Is Being A Data Scientist In Your Mind….? Using Emotional Intelligence To Deescalate Arguments

Using Emotional Intelligence To Deescalate Arguments How To Keep Your Office Boredom At Bay

How To Keep Your Office Boredom At Bay Contract Staffing leads to economies and talent retention

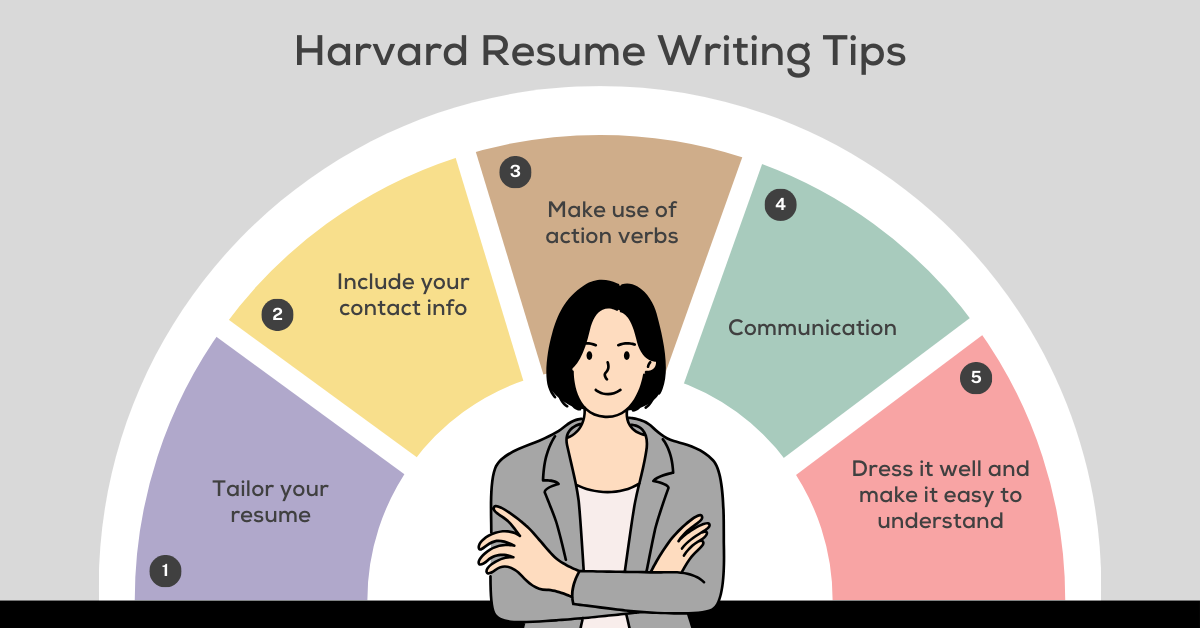

Contract Staffing leads to economies and talent retention Harvard Career Experts Explain How To Write Your Resume

Harvard Career Experts Explain How To Write Your Resume Fostering Psychological Safety At Work

Fostering Psychological Safety At Work Healthy Eating Tips For Night-Shift Workers

Healthy Eating Tips For Night-Shift Workers Top job websites to look for in 2021

Top job websites to look for in 2021 Lost job…? Here Are Your Sure-Shot Job Hunting Tips

Lost job…? Here Are Your Sure-Shot Job Hunting Tips What is work-life integration and how it works...?

What is work-life integration and how it works...? ! Good-Bye: 2020, Welcome 2021!

! Good-Bye: 2020, Welcome 2021! Give Thanks With A Grateful Heart! - CEO Message

Give Thanks With A Grateful Heart! - CEO Message Your LinkedIn Profile Is a Live Resume

Your LinkedIn Profile Is a Live Resume Must have traits to be a Successful Recruiter during COVID-19

Must have traits to be a Successful Recruiter during COVID-19 It isn’t What you say, It is How you say is called Communication

It isn’t What you say, It is How you say is called Communication Bonding + Rapport = Strong Pipeline

Bonding + Rapport = Strong Pipeline Empathy... Need of the hour !!

Empathy... Need of the hour !! W3Global, Inc. unveils New Logo and Redefines Staffing Strategies

W3Global, Inc. unveils New Logo and Redefines Staffing Strategies Ways To Survive The COVID-19 Crisis

Ways To Survive The COVID-19 Crisis Can’t wait for this moment

Can’t wait for this moment How to answer “why work here?” question like a boss

How to answer “why work here?” question like a boss Let never a “Video interview” invitation ever bother you anymore…

Let never a “Video interview” invitation ever bother you anymore… Second Interview nerves? Here are some tips to boost your confidence and help you conquer that interview!

Second Interview nerves? Here are some tips to boost your confidence and help you conquer that interview! How to make your Hiring manager think that they are crazy if they don’t hire you

How to make your Hiring manager think that they are crazy if they don’t hire you How to write a Professional Summary that will WOW hiring managers!

How to write a Professional Summary that will WOW hiring managers! How to catch the hiring manager’s attention from the get-go

How to catch the hiring manager’s attention from the get-go How to avoid rejections from HR Managers or Recruiters

How to avoid rejections from HR Managers or Recruiters How to grab a Recruiter’s attention by changing just 5 things in your resume

How to grab a Recruiter’s attention by changing just 5 things in your resume